Learn more about the Commercial Rooftop Units Idea and read the draft CRTUs MTI Plan.

CalMTA defines an RTU as a single-zone, packaged, forced-air, heating, ventilation, and air-conditioning (HVAC) system with between 3- and 20-tons of cooling capacity that is installed on the roof of a non-residential building.

CalMTA has established a three-tier framework for advanced RTUs. A CRTU is defined as any unit that incorporates one or more of the following features:

CalMTA anticipates that Tier 1 CRTUs will gain traction first, given their relatively low incremental cost, while Tiers 2 and 3 are expected to see broader uptake in later years. As the market embraces these targeted features, the overall adoption of HP RTUs is expected to rise.

*CalMTA defines AFDD+ as automated fault detection and diagnostics beyond current Title 24 requirements, which require economizer faults only.

In contrast to fixed-capacity and staged systems, variable speed heat pump RTUs offer more precise control of the compressor speed to adjust to the needs of the conditioned space at any given time. This results in fewer on/off cycles, lower startup power needs, better temperature and humidity control, and lower energy consumption.

Variable speed is an important technology for heat pumps. In mixed fuel RTUs, furnace (heating) and compressor (cooling) capacity can be sized separately to match the loads of a particular building. However, since heat pumps use the same compressor system for both heating and cooling, unless heating and cooling loads are roughly equivalent, heat pump RTUs need to be sized to meet either peak heating or peak cooling demand. In this case, the compressor will be inherently oversized during the opposite season, creating inefficiencies. Given California’s diverse climate and building stock, most existing buildings will have mismatched heating and cooling loads. The part load efficiency of variable speed compressors reduces the impact of these mismatched heating and cooling loads.

As a result, inverter-driven variable-speed heat pumps can significantly improve energy efficiency during both heating and cooling seasons, especially relative to fixed-capacity systems. Although 2-stage cooling (which is required by code for RTUs over 65kBtu/h) offers slightly better energy and comfort performance than fixed-capacity systems, it does not improve heating efficiency and does not offer the part-load efficiency of variable speed systems.

Products meeting CalMTA’s CRTUs MTI product definition are available, although there are currently few that incorporate all features and attributes — and most of the products that meet the definition are premium products with other features that add cost without significantly improving performance or energy savings in California. Furthermore, the approach manufacturers have taken towards some features, such as connected commissioning and controls, is inconsistent, creating different, and potentially negative, end-user experiences with some products.

Watch the September 29, 2025 MTAB meeting to learn more about the CRTUs Product Assessment.

Market transformation (MT) works to remove structural barriers and enact strategic interventions to create lasting change in a market. MT theory is the broad conceptualization of how best to address those barriers in order to accelerate adoption of a targeted energy efficient technology or practice. The changes created by strategic interventions grow market share and pull adoption forward in time.

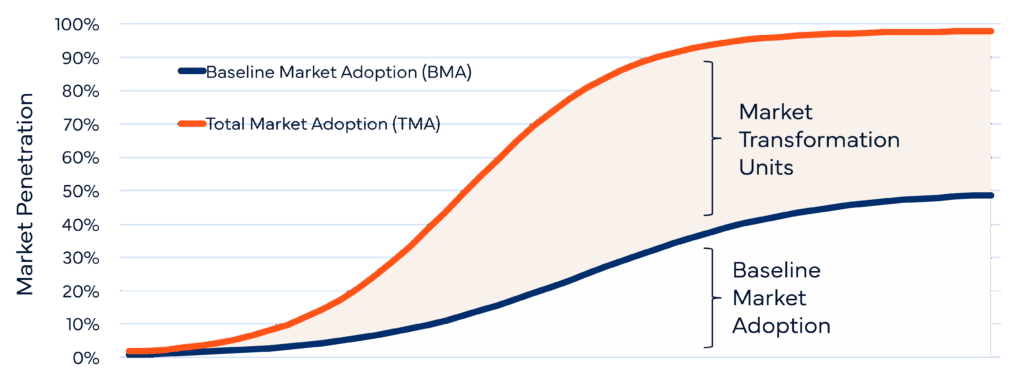

Figure 1 below shows the area between the Baseline Market Adoption and Total Market Adoption S-curves. The differential is the increase resulting from MT activities that deliver cost-effective energy efficiency, greenhouse gas (GHG) reductions, or other identified benefits.

MT theory works to establish clear, measurable inputs and outputs that can be assessed over time. Logic models provide a valuable roadmap to visualize the entire process of market transformation in a comprehensive chart. They depict barriers that make market adoption difficult, opportunities that can be leveraged for development, strategic interventions that will break down barriers and the resulting outputs over time. In other words, logic models map out the MT theory. CalMTA uses logic models for its initiatives to ensure coherent program organization and clearly defined, measurable outcomes for evaluation.

Market transformation works by removing barriers through a variety of interventions. The logic model expresses a variety of moving – and dependent – parts into a single model. A carefully conceived initiative logic model provides a tool for expressing and tracking program logic and is vital to successful market transformation.

We’ll use an example from the Commercial Rooftop Units (CRTUs) initiative. This initiative defines a Rooftop Unit (RTU) as a single-zone, packaged, forced-air, heating, ventilation, and air-conditioning (HVAC) system with between 3- and 20-tons of cooling capacity that is installed on the roof of a non-residential building.

CalMTA’s Commercial RTU Initiative will promote increased adoption of more efficient products, with integrated RTU connected controls and commissioning, variable-speed heat pump RTUs, and RTUs that exceed federal minimum cooling efficiency by at least 20%

Our team identified the limited availability of more efficient RTUs as a key barrier while noting the opportunity presented by the high number of heat pump rooftop units being sold in California. We’ve learned that more efficient rooftop units are often not stocked by distributors simply because building owners tend to do like-for-like replacements. We’ve also learned that heat pump rooftop unit sales make up nearly 80% of the market in new construction.

A logic model not only identifies these barriers and opportunities, but also the key strategic interventions required to remove the barrier or to engage the opportunity. A strategic intervention for the CRTU initiative is to design an incentive structure that influences the supply chain and ensures market confidence to further increase customer adoption. While new heat pump installations in existing commercial building across California is already estimated at 26-46% annually, the right incentives need to be in place across the supply chain to enable the continued growth of these more efficient CRTUs.

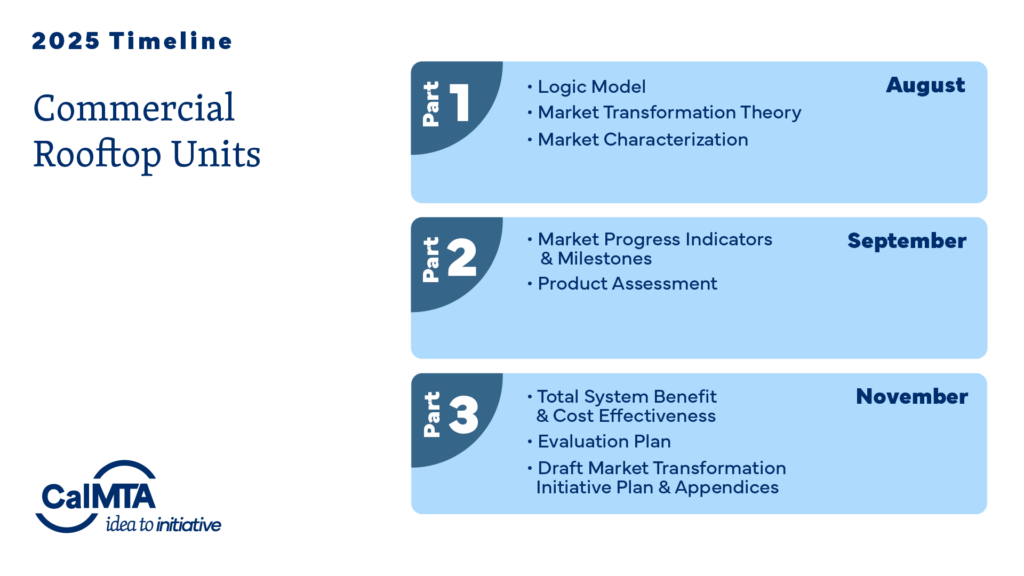

CalMTA uses a stage gate model in its Market Transformation Initiatives (MTI) strategy and program creation. A three-phase process with end-phase stage gates (shown below) helps manage program risk, maximize the use of resources, and increase transparency in our work. Learn more about the process here.

Advancement Plan approval is the stage gate that culminates Phase I: Concept Development and the plan includes a preliminary logic model. After the research and investigation described in the Advancement Plan is complete, an updated logic model is developed for inclusion in the Phase II stage gate deliverable, the MTI Plan.

Watch the August 20, 2025 MTAB meeting to learn more about the CRTUs Market Transformation Theory & Logic Model.

A Market Characterization study offers a detailed analysis of the structure, dynamics, and key players within a specific market. It helps identify opportunities and barriers for energy efficiency improvements and supports the design of effective programs and policies. After CalMTA develops an Advancement Plan for its market transformation initiatives (MTIs) in consultation with the Market Transformation Advisory Board (MTAB), we begin the process of studying the market for that product or practice through this research. In the case of CRTUs, we initiated the current market characterization study in order to build on the initial hypotheses put forward in our Advancement Plan and to better understand the unique barriers and opportunities that exist in California.

CRTUs can be divided into two major markets: custom design/build and “two-minute” purchases. Manufacturers estimate custom made CRTUs make up around 20% of the market and are targeted to precision applications, such as ice rinks and clean rooms, where the performance justifies the inherently higher cost custom design requires. Building owners for these kinds of special applications will buy these custom units.

The majority of the other 80% of CRTU purchasers, however, can be sorted into the “two-minute” market. According to one manufacturer in our study, the “two-minute” market is referred to as such because decisions on which RTU to install are made quickly. Unplanned replacements occur when an RTU fails and needs to be replaced right away. In this scenario, availability and price drive market decisions. A building owner or operator calls a mechanical contractor for a quote, and the contractor asks a distributor what unit is available in the appropriate size and includes features important to the customer. Contractors strongly prefer to buy RTUs that are readily available or can be delivered within a few days.

Most often, distributors place a large order for RTUs on a quarterly basis, which is then delivered to their local storage facility. Distributors stock what they believe will move off their shelves quickly. Interviews and previous studies reveal that minimum-efficiency RTUs are most often stocked, and high-efficiency RTUs are usually ordered from the manufacturer. As such, the majority of the two-minute market is minimum-efficiency RTUs that comply with code.

It may be surprising to some, but heat pumps are a significant share of the recent California RTU market. The majority (an estimated 79%) of RTUs in new construction from 2024 are heat pumps, which is likely driven by the 2022 Title 24 prescriptive regulations for single-zone space conditioning systems with direct expansion cooling (i.e., where the evaporator coil refrigerant absorbs heat and evaporates and expands within the coil, removing heat from the air outside of the coil). The replacement market, which has historically been driven by like-for-like replacements, has a smaller share of heat pumps (CalMTA research estimates between 26% and 46%). All major RTU manufacturers offer all-electric heat pump RTUs, although this option may not be available in all sizes and efficiency levels. One manufacturer explained these limitations are due to keeping the chassis size consistent across a range of cooling capacities and being limited by what fits.

Our market characterization study revealed several barriers impeding the broad adoption of the more efficient CRTUs that meet CalMTA’s product definition. These are especially pronounced in the two-minute market. Availability and costs (upfront and operating) are significant barriers toward adoption of energy efficient CRTUs and/or switching to a heat pump. Upfront cost is the most notable barrier given that building owners are responsible for full upfront costs and, on average, expect a CRTU to only last four years, which is very short compared to the California Technical Forum (CalTF) effective useful life (EUL) estimate of 15 years for a packaged heat pump air conditioner. Facility managers were more aligned with the CalTF estimate, expecting just under 14 years of service for a new CRTU.

The cost of energy, specifically the relatively high cost of electricity compared to gas, is another significant cost-related barrier mentioned by multiple market actors in regard to switching to a heat pump RTU. Even in leased buildings, most decision-makers were very or somewhat concerned about increased energy costs. Split incentives, which occur when building owners or developers are responsible for capital improvements while tenants are responsible for utility bills, means tenants generally do not have much influence when it comes to selecting a replacement CRTU.

Non-cost-related barriers include low awareness and product complexity. Consumers often lack awareness of the energy and non-energy benefits that efficient RTUs provide given that distributors and contractors often have difficulty explaining the value due to their own lack of experience with such products. Given the lack of familiarity or interest of purchasers, distributors tend to stick with code minimum equipment, which results in scarcity and long lead times when consumers are interested in buying efficient models. Product complexity can also result in contractor avoidance and lead to the potential for improper installation, which can reduce the installed system efficiency.

There is a shortage of experienced HVAC workers in California, especially during the busy summer months. Contractors explained that gas furnaces rarely break compared to air conditioners. This situation forces HVAC companies to train new staff and work hard to retain experienced workers, as poaching has become a major issue within the industry. The nature of the work is generally set in uncomfortable rooftop locations, especially in the hot summer months, which happens when demand for HVAC workers is highest. Many experienced workers age out from these difficult working conditions, while younger workers tend to drop out. Exacerbating the issue is that HVAC work is scarce in the winter, leaving workers with limited options to pursue when HVAC work is light, especially if they are not trained in other construction-related skills. HVAC workers serving the residential market also serve the light commercial market, creating competition for the same workers between the two markets.

Watch the August 20, 2025 MTAB meeting to learn more about the CRTUs Market Characterization.

The Logic Model is a systematic and visual way of presenting CalMTA’s understanding of the interventions necessary to remove barriers, expected outcomes of those interventions, and a pathway to the desired end state.

This report examines the California market for Commercial RTUs, characteristics of recent sales, supply chain dynamics, regulations and other factors influencing buying decisions, as well as the light commercial heating, ventilation, and air conditioning (HVAC) workforce.

Market transformation is a strategic process of intervening in a market to create lasting change. CalMTA developed a Market Transformation Initiative Evaluation Framework to lay out how we will track and evaluate the impact and cost-effectiveness of our MTIs. For each of our initiatives we develop a theory of market transformation and logic model that identifies expected short-, mid-, and long-term market outcomes resulting from strategic market interventions. Third-party evaluators will evaluate market progress based on the MPIs and Milestones developed for each MTI.

An outcome is the market’s response to one or more of the activities described in the MTI’s strategic market interventions. The end goal may be that more products meeting CalMTA’s CRTU product definition are adopted in the market, but this is a long-term initiative that must be assessed over time. While some outcomes will be realistic in a few years, others may take a decade to fully realize. For the CRTUs MTI, there are 19 outcomes showing in the draft logic model that we would expect to see from our work.

MPIs are metrics that correspond with logic model outcomes and are used to track market progress. Each of the 19 outcomes in the CRTUs logic model has one or more MPIs.

Milestones are the specific expected quantitative or empirical achievements, including timing, that correspond with certain MPIs. While MPIs are used to track market progress, Milestones track specific achievements. Together, these metrics allow CalMTA to assess MTI performance and identify areas that are performing differently than expected, so that the MTI implementation team can make timely course corrections, as appropriate.

CalMTA has identified several different strategic interventions necessary for transforming the market for CRTUs. The table below shows the outcomes we seek to achieve for this strategic intervention, along with the MPIs we’ll use to track our impact and the milestones that will show evidence of change in the market.

Note: This is one draft example from several planned interventions. The final MPIs and Milestones may be updated in the final MTI Plan due to be completed at the end of the year.

Outcome | Time | Market Progress Indicators | Milestone |

Education & Training materials developed and incorporated into industry trainings/education; inclusive of ESJ communities | Medium (4-6 years) | Number of HVAC training organizations (manufacturers, distributors, HVAC industry groups, education institutions, EE programs) that include CRTU in curriculum | 4 HVAC training organizations cover CRTU in curriculum targeted to California learners by 2032 |

HVAC Installers and workforce are trained, trusted and available for installations across the state without cost-premiums in ESJ communities | Medium (4-6 years) | Percent of HVAC companies with staff trained on CCC in each IOU service territory | 75% of contractors report staff can support CCC installations and service by 2033 |

Medium (4-6 years) | EQ19 – Percent of HVAC companies serving DACs reporting staff are trained on CCC | Percent of HVAC companies with CCC trained staff located in or serving customers in DACs comparable to general population by 2031 |

Watch the September 29, 2025 MTAB meeting to learn more about the CRTUs MPIs and Milestones.

The Total System Benefit (TSB) is the dollar-value metric that measures energy savings, grid benefits and reliability, and greenhouse gas (GHG) impacts. In 2021 the California Public Utilities Commission (CPUC) announced its intention to use this approach to evaluate the State’s energy efficiency programs to better align them with GHG emissions reduction, support for customer equity, and long-term grid stability. In the past, the CPUC’s dollar-value metrics had been based on kilowatt-hours, kilowatts, and therms, but this new TSB approach encourages programs to target high-value load reductions without directly comparing one fuel source against another (i.e., gas vs. electricity). It focuses on the benefits to the “total system” – including residents’ health and environmental concerns – rather than one particular fuel source. The CPUC officially adopted this new approach in 2024.

CalMTA is working to create energy efficiency and decarbonization initiatives that will transform the market. A crucial part of that work is understanding just how much a particular initiative will benefit statewide goals. While our market transformation initiatives (MTIs) seek to generate energy savings and related benefits by accelerating and increasing market adoption of energy-efficient technologies and practices, we need to evaluate those MTIs carefully. TSB is the measure we use to determine the MTIs’ potential impact. Good estimates require developing a forecasting model that uses a set of inputs based on well-documented sources, methods, and assumptions.

| TSB ($M) | Energy ($M) | Grid ($M) | GHG non-refrigerant ($M) |

| $595 | $148 | $147 | $300 |

Not only do the initiatives need to demonstrate a beneficial TSB; they seek to be cost effective. Cost-effectiveness is measured by comparing the initiative’s benefits with the costs. Various tests are used to provide different information about the impacts of the MTI from distinct vantage points. Together, these tests provide a comprehensive picture of the initiative’s cost-effectiveness:

The TRC and SCT cost tests help to answer whether efficiency is cost-effective overall. The PAC helps to answer whether the selection of measures and design of the program is balanced from the utility perspective. Collectively, these tests reveal the cost-effectiveness from the perspective of various stakeholders including program participants, utilities or California as a whole.

CRTUs MTI cost-effectiveness estimates, 2025-2046

| TRC | PAC | Base SCT | High SCT |

| 2.65 | 20.52 | 3.23 | 3.47 |

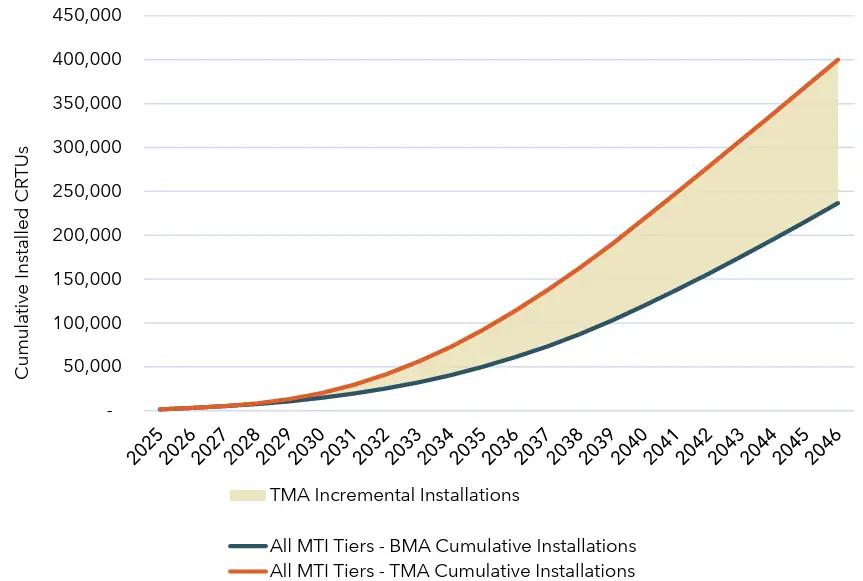

CalMTA has forecasted the baseline market adoption (BMA) and total market adoption (TMA) of CRTUs. BMA represents the expected “naturally occurring” market adoption, considering current and expected market, regulatory, and technological trends. Total Market Adoption (TMA) forecast represents adoption predicted to result from the strategic interventions described in the MTI plan and consistent with the MTI market progress milestones.

The figure below compares the forecast cumulative adoption in both the BMA and TMA and show incremental adoption – the area between the BMA and TMA curves – for all MTI CRTUs over the forecast period.

To learn more about the approach and methodology that CalMTA used to develop these forecasts, access Appendix B of the CRTUs MTI Plan.

Watch the November 12-13, 2025 MTAB meeting to learn more about the CRTUs TSB and cost-effectiveness.

CalMTA seeks to support statewide priorities on environmental and social justice and ensure MTI outcomes reflect the needs and desires of the communities they benefit. To this end, we are working with experts in the California market on equity program development and implementation, including engagement of a dedicated Equity Sounding Board. Learn more about CalMTA’s Equity Lens.

CalMTA applies an equity lens in its market transformation initiative (MTI) development process so that Environmental Social Justice (ESJ) communities receive the benefits of energy efficiency investment. Strategies for making targeted products and practices more accessible to ESJ communities, as well as activities that address unique barriers and opportunities in these communities, are woven throughout the MTI plans and will be proactively considered during implementation.

For the CRTUs MTI, CalMTA refers to ESJ communities as identified through the CalEnviroScreen’s SB535 DAC results dictionary

This MTI recognizes that ESJ communities are disproportionately impacted by both the upfront costs and the complexity and installation quality of HVAC replacements, particularly when replacements occur in emergencies or time-sensitive scenarios.

By focusing on cost-neutral design strategies (e.g., integrating low-cost sensors), and advocating for consistent, affordable product tiers that include connected controls and commissioning (CCC), the initiative seeks to embed equity into both product design and market delivery. Making these products more affordable and widely available will expand access to CRTU technology that reduces operational costs, improves building performance, and supports climate resiliency to ensure that ESJ communities are not excluded from California’s broader electrification efforts.

ESJ impacts are woven throughout all of the CRTUs MTI’s strategic interventions, but the following encapsulate those that will directly work to benefit ESJ communities:

Strategic intervention 1: Engage with manufacturers to prioritize development of variable speed CRTUs with integrated sensors, remote monitoring, and app-based commissioning tools to improve performance and usability for contractors, facility managers, and building owners.

Strategic Intervention 4: Develop and implement contractor training and business outreach strategies to increase installer awareness, confidence, and capability with CCC-enabled and variable speed CRTUs, while leveraging existing workforce development programs and trusted training hubs.

The California Market Transformation Administrator (CalMTA) develops and manages market transformation initiatives in the state to reduce energy use and reduce greenhouse gas (GHG) emissions.

CalMTA follows a rigorous process for reviewing, scoring, and then developing relevant, timely market transformation initiatives. The process supports market transformation initiative creation from concept to program development to market deployment, as well as the eventual exiting of the market.

Learn more about CalMTA’s planning and research on energy efficient technologies and our work to build California’s market transformation portfolio, and access quarterly and annual progress reports.

Want to learn more? Join our mailing list to stay informed about upcoming meetings and events, RFI and RFP announcements, and more.

We welcome your questions and suggestions.

Have questions or comments about CalMTA?

Use our contact form to connect with us, or reach out to:

CalMTA

Resource Innovations

719 Main Street, Suite A

Half Moon Bay, CA, 94019

(888) 217-0217

All Advisory Board meetings are open for public comment. If you’re unable to share your thoughts during an MTAB meeting, access our comment form to to provide your opinion.

Want to learn more? Sign up for our mailing list to receive twice-monthly updates about upcoming events, including Advisory Board meetings, informational webinars, important RFI deadlines, and more.