CalMTA’s early research for the Room Heat Pumps Market Transformation Initiative (MTI) identified a need to better understand how consumers install, interact with, and utilize this technology. Room heat pumps (RHPs) are self-contained products that provide efficient cooling and heating for small spaces, such as single rooms, modest apartments, or small homes. CalMTA has developed a market transformation initiative (MTI) that seeks to grow market adoption of these efficient and affordable alternatives to central air conditioners (AC) and less efficient heating sources.

Manufacturer marketing materials say these units can be self-installed by owners similarly to a window AC unit, but further study was needed for confirmation. The Room Heat Pumps Self-Installation Practices Strategy Pilot was developed to do just that with particular emphasis on two key issues: 1) the purported “self-installation” potential of the units, and 2) the relative portability of the units for tenants who own them. The final Room Heat Pumps Self-Installation Practices Strategy Pilot Report shares the results of the study, which can be found here. The full MTI plan is pending California Public Utilities Commission approval to move to implementation.

Local partners recruit study participants

To implement the strategy pilot, CalMTA sought partnerships with local organizations that have existing connections to environmental and social justice (ESJ) communities and currently support space conditioning upgrades for multifamily and small single-family residences (both renters and homeowners). Three organizations helped recruit and deliver units to households in the Bay Area and Northern and Southern California: Redwood Energy (Humboldt County), El Concilio (San Mateo County), and the U.S. Green Building Council – California (Los Angeles County).

Figure 1. The four form factors included in the pilot: a) portable, b) saddlebag, c) U-shaped, and d) window

The RHPs used in the pilot covered four of the available form factors: portable (45 units), saddlebag (53 units), U-shaped (18 units), and window (10 units). It should be noted that the U-shaped units were AC only because the U-shaped heat pump versions were not available at the time of the Strategy Pilot. As we were primarily interested in ease of installation and portability, the CalMTA team decided to move forward with the AC units because the test was focused on the form factors. All the other units were heat pumps that provided both cooling and heating.

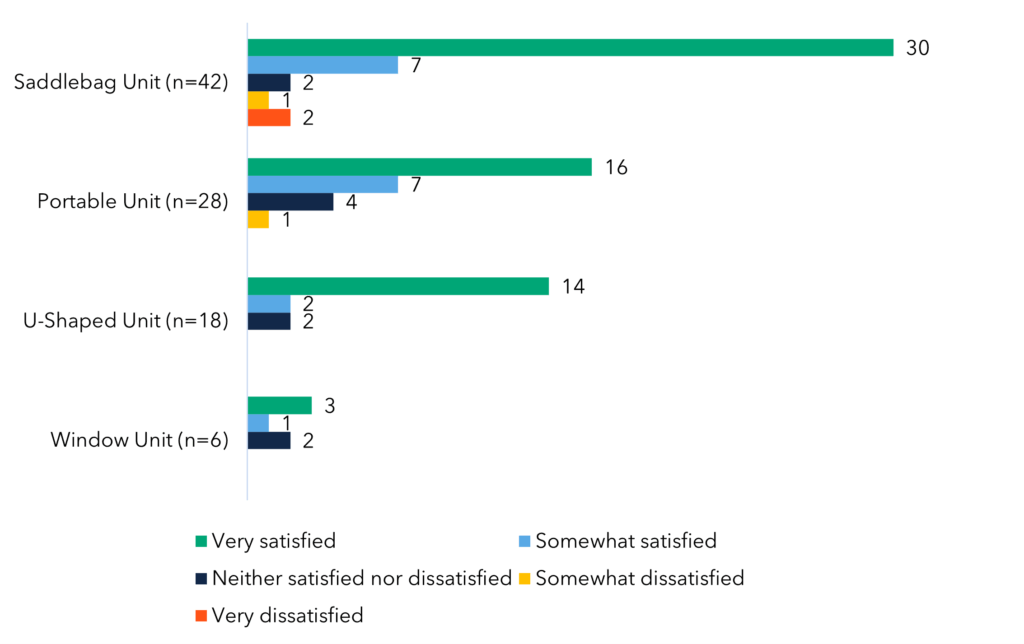

Participants completed post-installation surveys to help the team establish findings from the Strategy Pilot. Crucially, we were able to conclude that units usually required some form of assistance during the installation and that most participants planned to bring their units with them if they moved. Additionally, we learned that most participants did not have any form of AC prior to installing their RHP and that most reported high levels of satisfaction with their heat pump’s performance during the warm summer months.

Figure 2. Satisfaction with RHPs overall by unit type (n=94 responses)

Drawing conclusions

These findings allowed us to develop some vital conclusions and recommendations for feedback to the manufacturers of these new products as well as how CalMTA will implement marketing and installation guidance for consumers.

#1: The pilot validated the value proposition of RHPs.

Pilot participants reported high levels of satisfaction with all aspects of RHP performance. Yet it remains unclear whether RHP portability is a truly compelling value proposition. While most said they planned to take it with them, no participants in the sample had actually moved since receiving the heat pump.

#2: Self-installation of RHPs is feasible.

Most participants required assistance with the installation, most commonly to help them carry and/or hold the unit during installation, or to work through the instructions. Assistance with lifting was required almost exclusively for the units requiring window installation, while help understanding the instructions was most common with the portable units. There are several opportunities for manufacturers to improve the usefulness of installation instructions.

#3: Customers experienced performance issues with some early RHP product models.

Some units had excess water drainage, others would shut off after a few seconds, but the replacement units worked fine. It was recommended that the CalMTA team work with manufacturers to ensure they have addressed reported product performance issues as part of market partner agreements.

#4: Security concerns could pose a barrier to adoption for some customers.

A way to lock the window with the unit installed was important for some participants. CalMTA is recommended to work with manufacturers to include window locks or clear explanations for how to lock the window post-installation.

#5: Assessment of the impact of RHPs on electric bills was beyond the scope of this pilot and requires further study.

Nearly half of pilot participants reported experiencing some increase in their electric bills after using their RHP. This is likely due to not having any prior cooling source, though the actual causes of the reported increase cannot be substantiated from the pilot data.

#6: Future market adoption of RHPs will depend on the availability of products that fit horizontal sliding windows, which dominate California’s residential building stock.

The pilot validated that most existing RHP units are not compatible with much of the existing window stock in California. All units in the pilot, with the exception of the portable unit, require a single or double-hung window. CalMTA plans to work with manufacturers to bring models that work in horizontal sliding windows to California. To learn more about the Room Heat Pump Market Transformation Initiative, visit: https://calmta.org/resourcereport/room-heat-pumps-mti-plan/